NE Form 5 2024-2025 free printable template

Show details

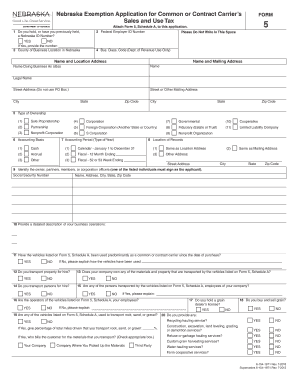

Nebraska Schedule A Nebraska Exemption Application for Common or Contract Carrier s Sales and Use Tax Schedule A Name as Shown on Form 5 List all motor vehicles trailers semitrailers watercraft and aircraft that will be used in a common or contract carrier capacity. RESET Nebraska Exemption Application for Common or Contract Carrier s Sales and Use Tax PRINT FORM Attach Form 5 Schedule A to this application. 2 Federal Employer ID Number Please Do Not Write In This Space 1 Do you hold or have...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nebraska form exemption

Edit your nebraska exemption common tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska form 5 common get form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska form exemption fill online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nebraska form exemption fillable. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Form 5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nebraska form exemption download

How to fill out NE Form 5

01

Start by downloading the NE Form 5 from the official website or obtain a physical copy from the relevant authority.

02

Fill in your personal details in the designated sections, including your name, address, and contact information.

03

Provide the necessary information regarding your tax ID or Social Security number.

04

Indicate the purpose of filling out the NE Form 5 accurately.

05

Include any relevant details or documentation required as per the instructions provided on the form.

06

Review all entries for accuracy and completeness before submission.

07

Submit the completed form either online, through the mail, or in person as per the guidelines.

Who needs NE Form 5?

01

Individuals who are applying for a particular tax exemption.

02

Businesses seeking to claim certain deductions or exemptions on their tax filings.

03

Non-profit organizations that require documentation for compliance purposes.

04

Anyone who is requested to provide additional tax-related information by the relevant tax authority.

Fill

ne exemption common carrier form

: Try Risk Free

People Also Ask about ne form exemption

What is exempt from Nebraska sales tax?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)LaundromatsNoneMedicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNone9 more rows

How do I get a resale certificate in Nebraska?

To obtain a resale certificate in Nebraska, you will need to complete the Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption (Form 13). Keep in mind that you first need a valid sales tax permit, as your sales tax identification number is required to complete the form.

What services are subject to sales tax in Nebraska?

Services in Nebraska are generally not taxable. However – if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products (also referred to as tangible personal property) are taxable in Nebraska, with a few exemptions.

How do I get a tax exempt number in Nebraska?

To apply for a Nebraska sales tax exemption, the nonprofit corporation must apply for a certificate of exemption by submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, to the Department of Revenue.

What items are exempt from sales tax in Nebraska?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Medicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNoneRepair laborNone9 more rows

How to fill out the Nebraska Resale or exempt sale Certificate?

For a resale certificate to be fully completed, it must include: (1) identification of the purchaser and seller, type of business engaged in by the purchaser; (2) sales tax permit number; (3) signature of an authorized person; and (4) the date of issuance.

How do I get tax exempt status in Nebraska?

A certificate of exemption is obtained by completing and submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, and any supporting documentation indicated on the Form 4, to the Department of Revenue for approval.

How do I apply for tax exempt status in Nebraska?

To apply for a Nebraska sales tax exemption, the nonprofit corporation must apply for a certificate of exemption by submitting a Nebraska Exemption Application for Sales and Use Tax, Form 4, to the Department of Revenue.

Is there sales tax on common carriers in Nebraska?

The purchase, lease, or rental of motor vehicles, trailers, semitrailers, watercraft, and aircraft (vehicles) used predominantly as common or contract carrier vehicles, and repair and replacement parts for these vehicles, are exempt from sales and use taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete nebraska exemption common form online?

Filling out and eSigning ne exemption form 2024-2025 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit ne exemption form 2024-2025 in Chrome?

ne exemption form 2024-2025 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit ne exemption form 2024-2025 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing ne exemption form 2024-2025 right away.

What is NE Form 5?

NE Form 5 is a tax form used in certain jurisdictions for reporting income and financial information related to nonresidents.

Who is required to file NE Form 5?

Nonresidents who earn income in the jurisdiction requiring the form and meet specific filing thresholds need to file NE Form 5.

How to fill out NE Form 5?

To fill out NE Form 5, gather the required income information, follow the instructions provided with the form, complete each section accurately, and submit it to the appropriate tax authority.

What is the purpose of NE Form 5?

The purpose of NE Form 5 is to ensure accurate reporting of income earned by nonresidents, helping the tax authority assess tax liabilities.

What information must be reported on NE Form 5?

NE Form 5 typically requires reporting of income earned, residency status, any applicable deductions, and personal identification information.

Fill out your ne exemption form 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ne Exemption Form 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.